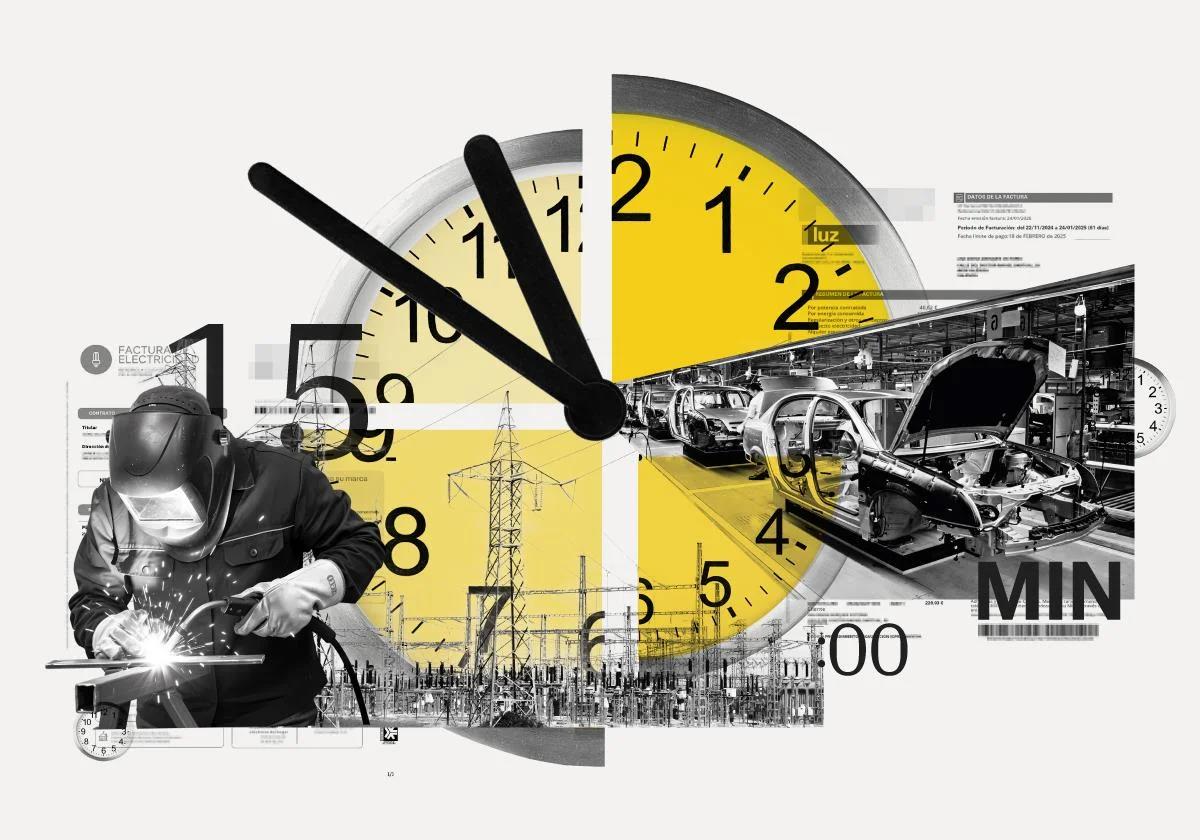

New 15-minute slots for regulated electricity market in Spain will lower industry's bills

Coming into effect on 1 October, a number of industry sectors will have more leeway to take advantage of periods with more affordable rates

The price of electricity on the regulated market in Spain will now be updated every 15 minutes, instead of every hour. This adaptation of the European regulated model, which will not bring palpable changes to private consumers, starts on Wednesday, 1 October. In other words, companies that produce, sell and buy electricity in the daily auction called the 'pool' will negotiate prices every 15 minutes, instead of every hour, as it has been done until now.

As a result, instead of 24 prices per day, there will be a total of 96 prices, which opens the door to more efficient and flexible management and to an economic opportunity for the industry, which will have more leeway to take advantage of periods with more affordable rates.

This change of model is significant, given that the price of electricity has not yet stabilised following the bill spike after the electricity collapse of 28 April. According to Eurostat data, the electricity bill in Spain rose by 14.7% in August, compared to the same month last year, while in neighbouring countries such as France, Italy and Portugal it fell by 13.6%, 4.9% and 2.3%, respectively.

The sun does not shine the same at 11.15am as it does at 11.45am, just as the wind can blow hard and then calm down just a few minutes later, causing a consequent drop in the output of a wind turbine. This asymmetry has been causing differences in the current model between the market result (expected supply and demand) and the real needs (actual supply and demand) that are paid in the secondary market - known as the balancing market - managed by Spain's Red Eléctrica. It was further highlighted by the massive entry of renewables into the system, with a cost overrun due to calculations that were not in line with reality and that will be avoided with the quarter-hourly offers.

Increasing the number of these power purchase and sale packages will better match supply and demand at any given time, reduce the risk of mismatches when there is a surplus or shortage of electricity and prices will better reflect the real-time situation of the system as a shorter interval gives more flexibility to market participants, according to sources from the Spanish market operator (OMIE).

Who will be affected by this change of model? Mainly marketers and generators, OMIE and Red Eléctrica. Therefore, they are the ones that must adapt their systems. From the consumption side, it will only affect industrial customers on the voluntary price for small consumers (PVPC), especially those in energy-intensive sectors. For these companies, having more precise pricing will allow them to adjust production or consumption schedules, take advantage of the cheapest times of day and optimise costs.

Once again, the change is not a trivial matter, especially at a time when industry as a whole, and especially energy-intensive industry, is raising its voice about what is happening to grid access. Companies that technically can want to switch from gas to electricity. Among them, there is a growing fear of losing billions of investment due to the saturation of electricity grids.

The new market will also be beneficial for new flexible solutions such as storage or self-consumption, which will have more scope to optimise their market share and take advantage of more convenient prices.

For private consumers, there are no domestic meters that measure on a quarter-hourly basis, so customers on the regulated market will continue being billed on an hourly basis, in accordance with current legislation. In other words, those with indexed tariffs and less than 50 kilowatts contracted will continue to be billed on the basis of interpolated hourly data. This interpolation is done for the settlement of the deviation in the wholesale market, so it does not apply to retail or domestic billing. Regardless of the tariff chosen, all consumers will benefit indirectly from a grid that is more secure and stable and that will prevent future blackouts. In addition, prices will tend to better reflect the availability of energy.

Aligning with European regulations

This change of model is neither capricious nor exclusive to the Iberian Peninsula. Europe has been working on it for a decade. The model is dictated by European regulations, which require both balance settlements and daily trading to be done in 15-minute intervals.

Now, after several postponements due to "technical problems", it is Spain's turn to adapt it. The increase from 24 to 96 trading periods per day means a fourfold increase in the volume of data to be processed and managed. To meet this challenge, Omie has made significant financial investments, as well as technical developments in close coordination at European level, with the aim of ensuring that the market operates with "maximum reliability and accuracy" from day one.