Cyber scams increase by 60% in a year and 45 cases a day are reported in Malaga province

Fraud using email, text messages, social media or the internet now accounts for one in five crimes committed in the province

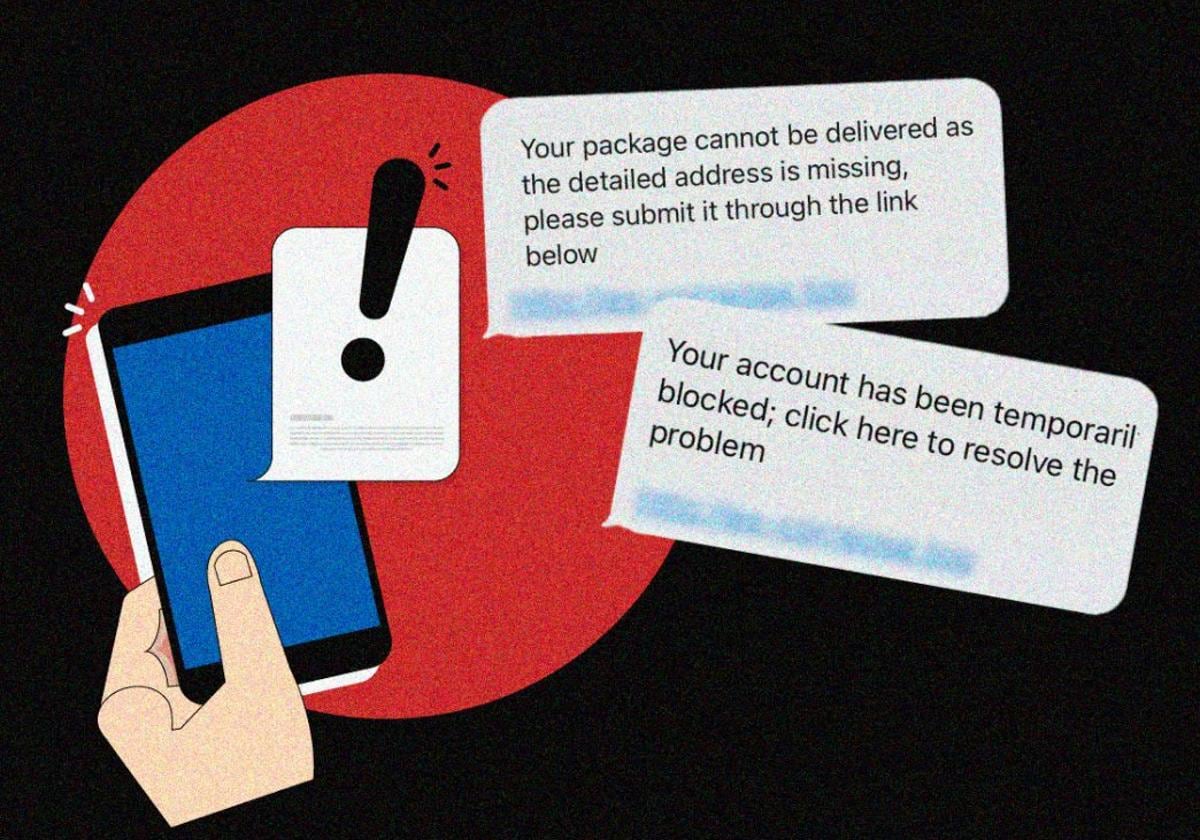

How is it possible that people are falling for this obvious scam?" It is likely that you have made a comment similar to this one at some time. And it is equally likely that you have been or will be a victim of a scam via email, online store, SMS text or WhatsApp. You don't have to be ignorant or gullible to fall for it; it is a question of it coming at the right - or rather wrong - time. For example, if you're waiting for a delayed parcel, you'll be more likely to click on a text message alerting you to a problem with the post office. Or if your child is studying abroad, you are more vulnerable to an "I've lost my mobile and need money" message.

"We need to come out of the closet about digital scams. People are ashamed to talk about them and, for the same reason, they don't ask for help when they are in trouble. The more people talk about them, the more alert we will be," said Braulio Díez, a veteran computer developer and co-founder of Lemoncode programming school, who said that he himself almost got caught out by a fake message from the post office. "And like me, many people I know who work professionally in the IT sector," he said.

Data shows cyber scams are becoming an epidemic. According to the Balance de Criminalidad de 2023, a crime report prepared by the Spanish Ministry of the Interior, during that year 16,334 computer scams were registered in the province of Malaga. In other words, an average of 45 a day. It is the criminal offence that grew by far the most: 60 per cent compared to the same period the previous year, and it already represents more than 20 per cent of the total number of crimes. The increase has been particularly high in Malaga, the fifth province in the whole country with the highest percentage rise in these crimes and also the fifth with the highest total number of complaints. If other types of cybercrime are added (there were 1,729 in the same period), online offences reached 18,063 cases last year.

"In this report, and as a fact associated with the use of the internet in Spain that has been observed for some years now, and very significantly since 2016 (especially in the growing forms of online retail), there is again a notable increase in the types of crime grouped under the concept of cybercrime, especially a sharp increase in fraud," the report itself reflects.

A survey by the Centro de Investigaciones Sociológicas (CIS - Spain's public research institute) recently revealed that almost half of Spaniards (47.4%) have been scammed or faced an attempted scam over the internet in the last year. The most common channels through which the bait arrives are email and SMS text messages: 40% of those surveyed stated that they had received a request for personal or financial information via these means. This is followed by WhatsApp: 31% say they have received fake messages or attempted scams. The third most common channel is online shopping platforms, which are reported by 17.4% of respondents. Finally, 7.3% say they have suffered from theft or identity theft on social media or websites.

Within the broad typology of cybercrime (from sophisticated 'ransomware' attacks targeting companies or institutions to 'sextortion'), scams targeting members of the general public are obviously the most numerous, as they are launched on a massive scale. 'Phishing', 'spoofing', 'smishing', 'vishing'... the methods are constantly evolving, but the essence is basically the same: social engineering.

Spain's national cybersecurity institute, Incibe, defines it as follows: "A technique based on the manipulation of people to get them to perform some action without being aware that they are being deceived. Cybercriminals use this technique to obtain valuable information, such as users' passwords or personal information, as well as to access their bank accounts or other online systems of interest to them in order to obtain some kind of benefit, which will generally be financial."

"Reversing the initiative"

For this very reason, whatever the specific method used by cybercriminals to try to steal our money (new ones are being identified every day), the golden tip to avoid being scammed is always the same: be suspicious as a matter of course.

"Take back the initiative," as Andrés Román, a chief inspector of the National Police and head of the Cybercrime Section of the Malaga provincial police station, calls it. "When you receive a warning via text, call or email, be suspicious and be the one to call the company, the bank or wherever. Simply by following this rule we would avoid many cases," he explained.

Whatever the hook (an irresistible offer, a problem with your bank account or a problem with the delivery of a parcel), don't get carried away by urgency. Nor should you click on any link or download any file that appears in an email, WhatsApp or SMS; nor should you buy from an online shop without making basic checks. What should we check? Make sure that the website or email domain really belongs to the organisation in question (there may be almost imperceptible changes, such as "gooogle.com" instead of "google.com") and search the internet to see if what you have received on your mobile or email has already been reported as fraudulent by other users. Be careful: do not blindly trust the 'padlock': the 'https' protocol does not guarantee that the website is from who it claims to be. And most importantly: never, under any pretext, give out bank account or credit card information (full passwords or security PIN numbers) by any means

I've been conned, what do I do now?

When you receive a potentially fraudulent message the advice is, of course, not to click on any links or download any attachments it contains and to mark it as 'spam' and delete it.

If this recommendation arrives late and personal and/or bank details have already been provided on a fraudulent website, Incibe's recommendations are as follows:

-Take screenshots and preserve as much evidence as possible. There are applications called 'online witnesses' to authenticate such evidence.

-If banking information has been provided, the bank should be contacted immediately to report the incident so that the necessary measures can be taken: cancelling cards, changing passwords, etc.

-During the following months, it is advisable to 'egosurf' (search yourself on Google and social media) to confirm that personal information has not been exposed.

-If you have downloaded and run an attachment, it is advisable to take the following steps: disconnect the potentially compromised computer from the home network to prevent the malware from spreading to other devices; run a full system scan with an antivirus; and, if you think the device may still be infected, you can resort to resetting it to factory settings.

- File a report with the police, providing any evidence of fraud that may have been obtained.