Optimistic forecast for mortgage market in Malaga from leading economic expert

Professor Gonzalo Bernardo speaks of a "red hot" property market and a "boom" of young people who are going to escape "the rental trap" by borrowing to buy

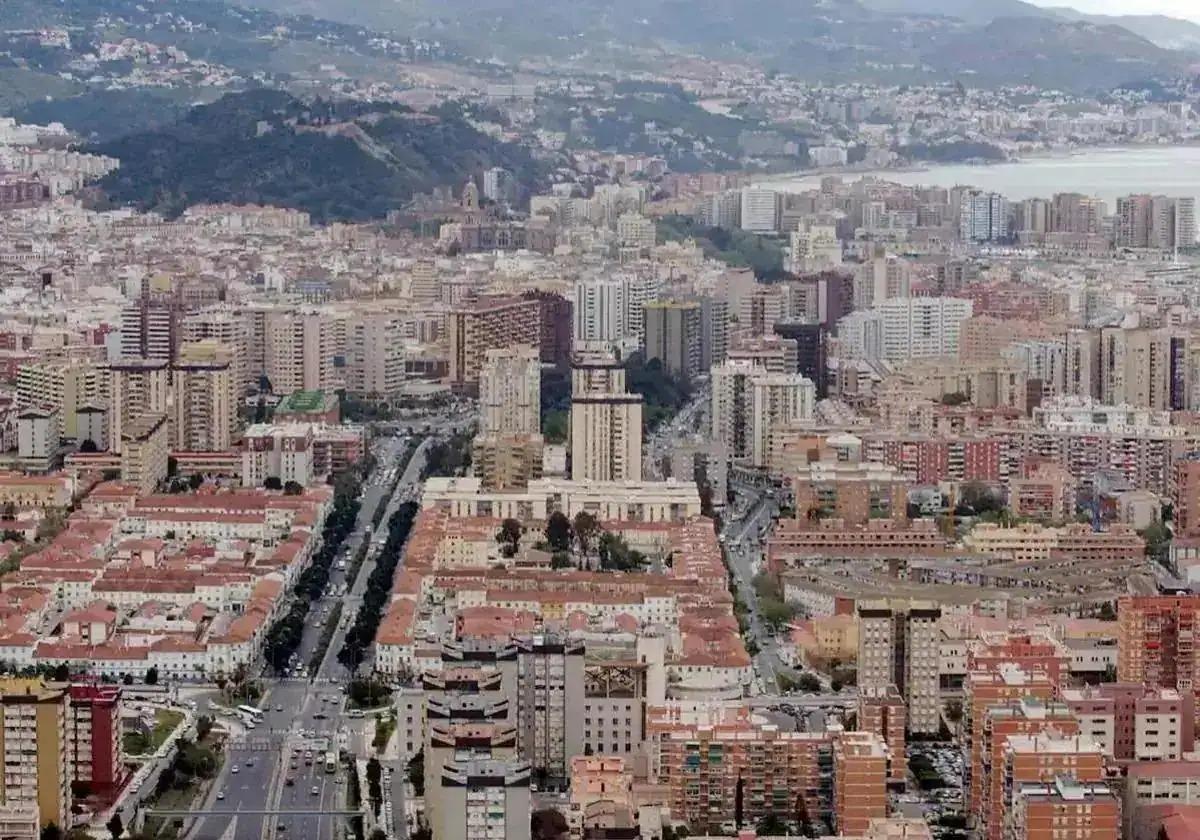

The transition from one year to the next is a time to take stock and make forecasts. In Spain, and Malaga in particular, one of the main focal points gathering such attention is the housing market. The high prices and lack of an affordable supply of homes were the cause of massive demonstrations in Malaga and other Spanish provinces last year. In spite of everything the prices for apartments, both for purchase and rent, continued to rise in 2024, much more in the Costa del Sol capital and Malaga province than the Spanish average, mostly due to the pressure exerted by demand, population growth and also affected by the tourism component belonging to this location on the national map. For these reasons Gonzalo Bernardos, Professor of Economics at the University of Barcelona and expert in the real estate market, is confident that "the housing market is red hot" and will remain so in the year 2025, which has only just begun.

Bernardos puts numbers to these words and anticipates a rise of 12% in the price of pre-owned housing and 15% for new housing. He also believes that demand will be mainly from the middle and lower-middle classes, especially from young people under 40 years of age. Likewise, if he calculates that the demand for new housing in Spain as a whole will be 400,000 units, barely 150,000 new homes will be produced. This excess demand for new housing will be transferred to the pre-owned market.

In general for the whole of Spain, but also for Málaga, Gonzalo Bernardos estimates that many young people this year "will get out of the rental trap" and go on to buy a home with the help of their parents. According to his analysis, there is a lot of mobility of young people in the labour market, which means that they are improving their salaries and also securing more stable work contracts. "Now they have more solvency, more stability, interest rates are lower, they only lack the previous savings, which will be provided by their parents", said Prof Bernardos. Besides parental help, he also notes that more and more financial institutions are giving mortgages for more than 80% of the value of the property, and even up to 100%. "Young people are going to buy homes on a massive scale. We are going to hear talk of a bubble again."

All of this will mean, he argues, that credit granted by banks will grow by 35% this year compared to last, while the number of mortgages will increase by 25%. "Banks are going to lend an enormous amount of money," he said.

While he does not overlook the fact that the economic situation in Europe, especially in France and Germany, is "horrendous", he believes that it will not have an impact on the Malaga property market: foreigners will continue to buy houses. Furthermore, he is convinced that: "We are not in a tourist housing boom, but one of young people who are going to get out of the rental trap."