New waste management tax hits self-employed and small businesses in municipalities already applying it

Faced with widespread outrage over charging self-employed individuals for premises they have not even occupied, the town hall has promised to review each case for future adjustments and stated that the tax is a mandate from the central government which is implementing an EU directive

Alhaurín de la Torre's local council began the procedure for the approval of the modification of the tax bylaw regulating the fee for the provision of domestic waste management services around this time last year.

From the very start, this new tax obligation was rejected by several parties, both from the left and the hard-right. Socialist representatives urged the town hall to seek other solutions, as the modification of the fee was going to be detrimental to people's finances.

However, the ruling party in the local government (PP) stated that the regulation was obligatory, as ordered by the central government, which, in turn, was responding to an EU directive. In other words, it was a mandatory step for the whole country. The new bill was to start being applied on 1 January 2025, but Alhaurín de la Torre taxpayers only started receiving it between August and September.

913 euros per quarter

In the notifications sent by the supramunicipal body responsible for tax collection, it is stated that, in Alhaurín de la Torre, the charge corresponds to the industrial waste tax bill. Previously, this did not exist, as it was linked to the water service, according to councillor for finance José Manuel de Molina.

Fran, who runs a gym in the industrial area, received a 913-euro bill. He described this as "a joke". He was surprised by how abruptly the new tax has been introduced. He and other people in a similar position (around a hundred, according to him) are already trying to persuade the local government to make changes to the bill. "We are going to seek legal advice and it is also possible that we will take this to the streets," Fran said.

María Luisa Sánchez Chica, owner of the famous Pedro Vázquez restaurant, has also received a heavy bill of 913 euros per quarter. She believes that she is being charged the maximum for the recycling of all categories (paper, glass, plastic) and for the entire plot of 8,000 square metres, even though her restaurant is only part of that. She also announced her plans to take action and make a formal complaint. According to her, the tax will affect many small- and medium-size businesses and some might even be forced to close.

Opticians and law firms

"I have an optician's shop, in rented premises and I have been charged 170 euros for the first quarter of the year for recycling," Mónica Aguilar said. "I have asked colleagues who have similar businesses in other places and I am the only one who has been told to pay for this." Mónica's waste accumulates in "one or two 20-litre bags" per month.

Quota

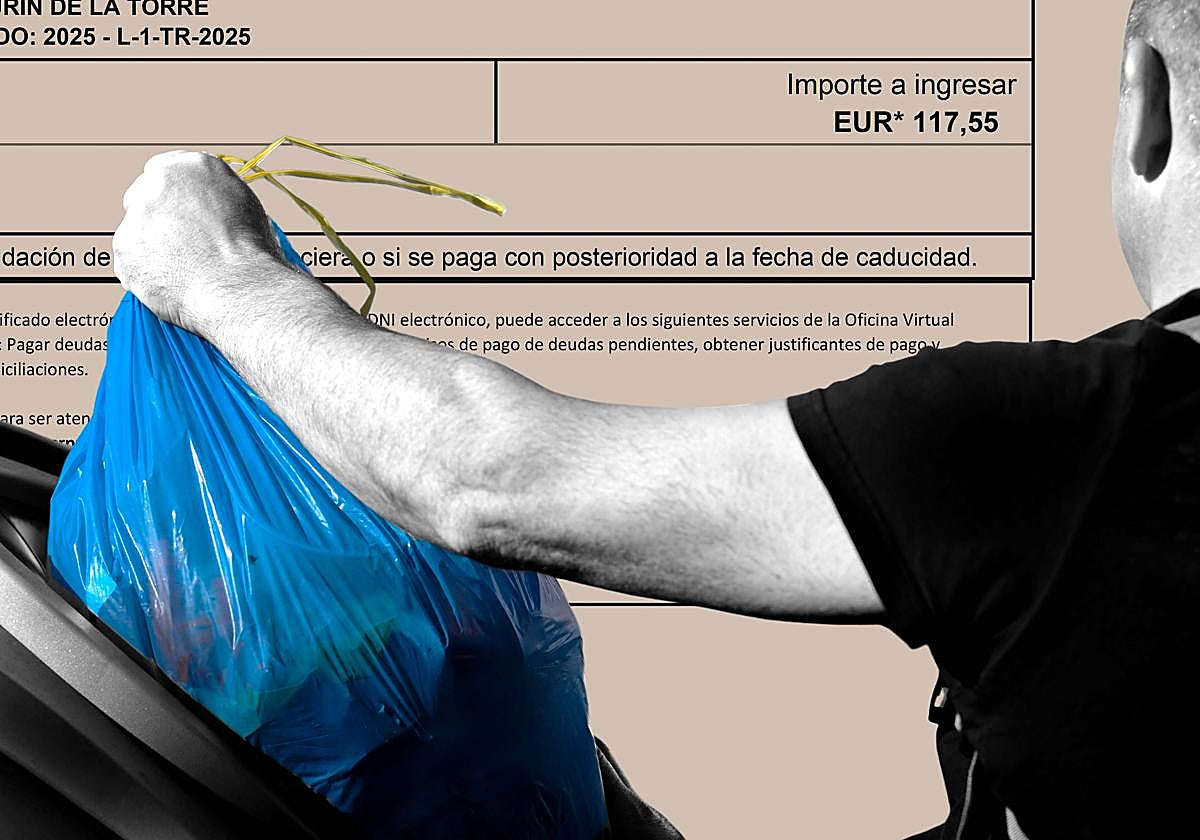

117.5

A telling illustration of what the new fee entails is the fee for practicing law in an office, which exceeds 100 euros per quarter

The tax, which even the PP has declared burdensome, is particularly harmful to small businesses and the self-employed.

Estíbaliz Calderón Peña, who works with her husband in a 42-square-metre beauty salon, has to pay 300 euros for January, February and March. She said that, when calculating their tax obligations, the authorities took into account that there are two self-employed workers operating from the same premises. Considering that they are both engaged in the same line of work, this calculation doesn't make sense to her. She called for personalised analysis of each case.

According to sources, another sector that has been more severely hit by this tax are lawyers, even those who work from home.

Incorrect data

Alberto Aguilar was given a bill for premises that he is not occupying and that he has had "nothing to do with since 2023". "I can understand that there is a waste management tax, but I don't get how they collect the data to calculate the tax," he said. The tax authority responsible for implementing this regulation responded to his complaint by saying that it would be best for him to pay the tax and then file a claim for reimbursement.

Another restaurant owner, Sergio Megías, said that he has been charged 385 euros, "retroactively", for the first quarter of waste management. However, he admitted that he was not surprised, given the reputation of Alhaurín de la Torre as "one of the towns with the highest taxation" and prices, especially for the self-employed. "On top of that, we get a notice announcing that we can be fined up to 6,000 euros for not leaving the rubbish in the bins," he said, adding that the local administration does not necessarily take care of the deposit stations correctly.

Criteria

José Manuel de Molina has said that the new tax was the result of a prior study which determined that, since self-employed workers and businesses also had to be taxed, the calculation would be based on data from the economic activities tax (IAE) and the square metres of the premises linked to each taxpayer.

In this way, seven categories of waste generation were established according to the type of business, with a progressive scale of intensity determining the amount to be paid, from the lowest to the highest impact, and eight size brackets based on the surface area occupied. The combination of these two factors determines the final amount of the tax.

In the case of residential properties, there is a fixed quarterly fee of 7.75 euros and a variable fee (also charged quarterly) calculated by multiplying a rate of 0.0002938 by the cadastral value of the taxable property.

This calculation model, for example, makes it possible to exempt taxi drivers, who do not work on physical premises, from paying tax, even though they do declare IAE.

Revisions and adjustments

However, the councillor acknowledges that it will be necessary to make revisions and adjustments in order to ensure that the amount paid is adequate. Moreover, Alhaurín de la Torre is a "pioneer" in the implementation of this tax, which implies that the regulation might not be polished yet. However, De Molina says that this will always be done under the principle established by the EU, namely that the actual cost of providing the service must be shared among all residents.

According to the report commissioned by the town hall, presented in 2024 as a preliminary measure before changing the waste collection regulations, the total annual cost of providing this service amounts to 4,617,941.97 euros, while revenues from this source currently stand at 2,170,000 euros.

De Molina advised all business owners and workers who believe that they have been overcharged to make a formal complaint, which will be reviewed by the local government. He said that, although it is possible that they will be reimbursed for the excess amount, the tax must always be paid. Otherwise, they could be sanctioned.

De Molina said that Alhaurín de la Torre applies deductions of up to 50% for the waste collection service to families at risk of social exclusion and bonuses for going to the recycling centre.

Other cases

De Molina announced that, regardless of the need to modify any injustices, the tax is here to stay. He added that it should also be implemented throughout Spain. Malaga city, for example, is expected to do so in 2026.

To cite other examples, Torremolinos has approved a modification of its tax regulation to increase the number of people subject to the industrial waste tax and to include owners of tourist accommodation (VUTs). In this way, the town hall makes sure that the municipal coffers will receive one million euros during the financial year, without harming residents.

In Rincón de la Victoria, taxes for households have risen from 103.24 to 162.47 euros, while for commercial properties they have increased from 277.21 to 404.35 euros.

The unit that currently pays the most, a detached single-family home, rises from 153.70 to 216.80 euros per year. For standard commercial premises, the amount goes from 145.22 to 248.76 euros under the modification.